However, while physical money (cash) is accessible to anyone, virtual central bank money is restricted to a few financial intermediaries. Berentsen and Schär (2018) suggest that central banks should not create new cryptocurrencies but should allow anyone to open an account with them. Calderón and Stratopoulos (2020) show how the blockchain of the Listerine® supply chain works; this product is a mouthwash produced by J&J, a multinational pharmaceutical company. Listerine managers use blockchain to assure the provenance of input and to facilitate better coordination and trust between members. Notably, although every peer maintains a copy of the chain (hence, it is decentralized), it also entails an element of centralization because of its identity provider and ordering node. A promising accounting context in which blockchain could quickly become part of the status quo is sustainability reporting because there is a need to improve the transparency and assurance of the information that entities disclose to prevent green-washing policies and practices (Bakarich et al., 2020).

- When audit technologies are at their most powerful, they work together as part of an effective audit methodology that incorporates the judgment and experience of auditors, all of which come together to provide very high-quality audits and generate insights that inform larger business risks and opportunities.

- The information that is stored on the blockchain offers us a level of transparency that has not previously been seen.

- Second, it investigates how accounting and auditing practices are impacted by blockchain.

- In a cooccurrence analysis of keywords, the relatedness of the entries is based on the number of documents in which the keywords occur together.

- Thus, cryptos fall under the accounting rules for “Intangible assets with indefinite useful lives” (IAS 38.107), so they cannot be amortized but only impaired.

- Figure 4 (cooccurrence analysis of the authors’ keywords) and, with more details, Figures 5–7 (cooccurrence heatmaps of the authors’ keywords by cluster) confirm the reliability of not only the keywords chosen for the SLR but also the three clusters, which are consistent with the words most used in the analyzed papers.

McCallig et al. (2019) propose a prepaid rent prorated rent what you need to know blockchain system that overcomes the privacy issues the use of multiparty security and modular arithmetic. However, their system requires communication between all involved entity customers or suppliers. In this area, researchers study how to apply blockchain to accounting and design data flows and architectural features. Deloitte celebrates its 175th anniversary in 2020, and audit has undergone multiple sea changes in those years. At each inflection point, it has re-established its vital role in building trust and confidence in the capital markets and in the investing public.

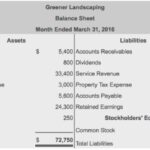

Figure 2.

We used a thesaurus file to merge similar keywords (e.g. “audit” and “auditing,” “cryptocurrencies” and “cryptocurrency”). The keywords were grouped into clusters, namely, sets of closely related nodes within a bibliometric network. To create this form of bibliometric network visualization, VOSviewer uses colors to indicate the cluster to which each node has been assigned considering the cooccurrence relations. The clustering technique used by VOSviewer is discussed by Waltman et al. (2010). The weight of a node is based on the number of occurrences of the corresponding keyword. First, this SLR provides a clear picture of the state of the accounting research on blockchain using bibliographic and narrative analyses.

Learn how our auditors work with Deloitte COINIA to help address blockchain. This effectively means that Person A has a copy of all of their information as does Person B, and as does the next person. In a decentralized environment, all participants have access to the same information and users can then choose to share it or not. Information will no longer need to be aggregated and stored in central databases as it will be stored everywhere at once and, if desired, under direct user control rather than the company offering the service.

Therefore, the issue of accountability based on blockchain represents a tremendous opportunity for future research. The success of cryptocurrencies has enticed entrepreneurs, academics and practitioners to study their innovative underlying technology, the blockchain and its opportunities in many different sectors. Hence, blockchain became a tool to innovate and could disrupt wave life sciences ltd and create new business models.

3 Search for the literature

First, this SLR provides a clear picture of the state of accounting research on blockchain. The engagement of academics and practitioners with the potential of blockchain and technological advancements is growing but limited (Schmitz and Leoni, 2019). At this crucial moment for the distribution and development of blockchain technology – when large companies, institutions and major audit firms have already become convinced adopters (EY, 2020; PwC, 2020) – our study provides an up-to-date, comprehensive SLR of 346 research products indexed on Scopus.

Our deep business acumen and global industry-leading Audit & Assurance, Consulting, Tax, and Risk and Financial Advisory services help organizations across industries achieve their various top 10 functions of accounting blockchain aspirations. Reconciliation of accounting data will not be fully automated through blockchain technology as auditors’ professional expertise and experience is required to assess the accuracy of complex accounting transactions. However, the ability to trust that both parties are recording the same base transaction information and the real-time availability of this accounting data offers immense benefits for the efficiency with which accounting data can be reconciled and analyzed. Due to distributed ledger technology, blockchain technology eliminates the need for entering accounting information into multiple databases and potentially removes the need for auditors to reconcile disparate ledgers. This could save substantial amounts of time and the risk of human error may be considerably reduced. Among the possible developments of this study in terms of the practical and theoretical applications of blockchain technology to accounting, we mention the possibility of overcoming the problem of data privacy through the use of public blockchains.

Some research products have used general frameworks such as the technology–organization–environment framework (Dai and Vasarhelyi, 2017) and the unified theory of acceptance and use of technology (Ferri et al., 2020). Many others do not refer to a theoretical framework in their analysis of this phenomenon because they provide general overviews of the possible uses, benefits and limitations of blockchain in the context of accounting (Pimentel and Boulianne, 2020). It’s clear that technology is changing the way organizations do business across all functions and industries. But there are particular pairings of tool and team that carry game-changing potential.

Blockchain Technology: Shaping the Future of the Accountancy Profession

Table 2 provides some quantitative data (total citation and CPY) regarding the studies with the highest impact on this topic. Figure 1 shows the distribution over time of the included research products. The green line represents all 127 research products that belong to the “Accounting and Auditing” topic. The yellow line depicts articles published in journals ranked as “ACCOUNT” by the ABS AJG2021 journal ranking. Figure 1 shows a considerable increase in interest since 2016, in which year accountants and practitioners began to seriously consider blockchain as an accounting tool (Kokina et al., 2017). As blockchains allow recording and settlement of transactions to occur at the same time as the transaction itself, auditors can obtain data in real-time and in a consistent, recurring format.

Blockchain in accounting practice and research: systematic literature review

Gabriella Kusz was a principal, Strategic Initiatives, at IFAC where she supported accountancy’s leadership and innovation in the digital era. Van Hoek (2019) notes that a need for transparency and visibility motivates blockchain implementation and that the main barrier facing such an implementation is a lack of understanding of how to integrate and leverage blockchain investments. The Court of Justice of the European Union (2015) decided that exchanges of cryptocurrencies are VAT exempt under the provision that exempts means of payment. The IRS (2014) of the USA declared that virtual currencies must be treated as property. Accounting for cryptocurrencies as cash falls under IAS21 “The Effects of Changes in Foreign Exchange Rates” if one adopts a broad definition of cash that goes beyond legal tender status (Procházka, 2018; Hampl and Gyönyörová, 2021).