These property classes are also listed under column (a) in Section B of Part III of Form 4562. For detailed information on property classes, see Appendix B, Table of Class Lives and Recovery Periods, in this publication. To make an election, attach a statement to your return indicating what election you are making and the class of property for which you are making the election. If costs from more than 1 year are carried forward to a subsequent year in which only part of the total carryover can be deducted, you must deduct the costs being carried forward from the earliest year first.

- The business part of the cost of the property is $8,800 (80% (0.80) × $11,000).

- 4134, Low Income Taxpayer Clinic List, at IRS.gov/pub/irs-pdf/p4134.pdf.

- Qualified nonpersonal use vehicles are vehicles that by their nature are not likely to be used more than a minimal amount for personal purposes.

- Written documents of your expenditure or use are generally better evidence than oral statements alone.

- You are a sole proprietor and calendar year taxpayer who works as a sales representative in a large metropolitan area for a company that manufactures household products.

Role of IRS & Accounting Standards in Defining Depreciation for Tax Purposes

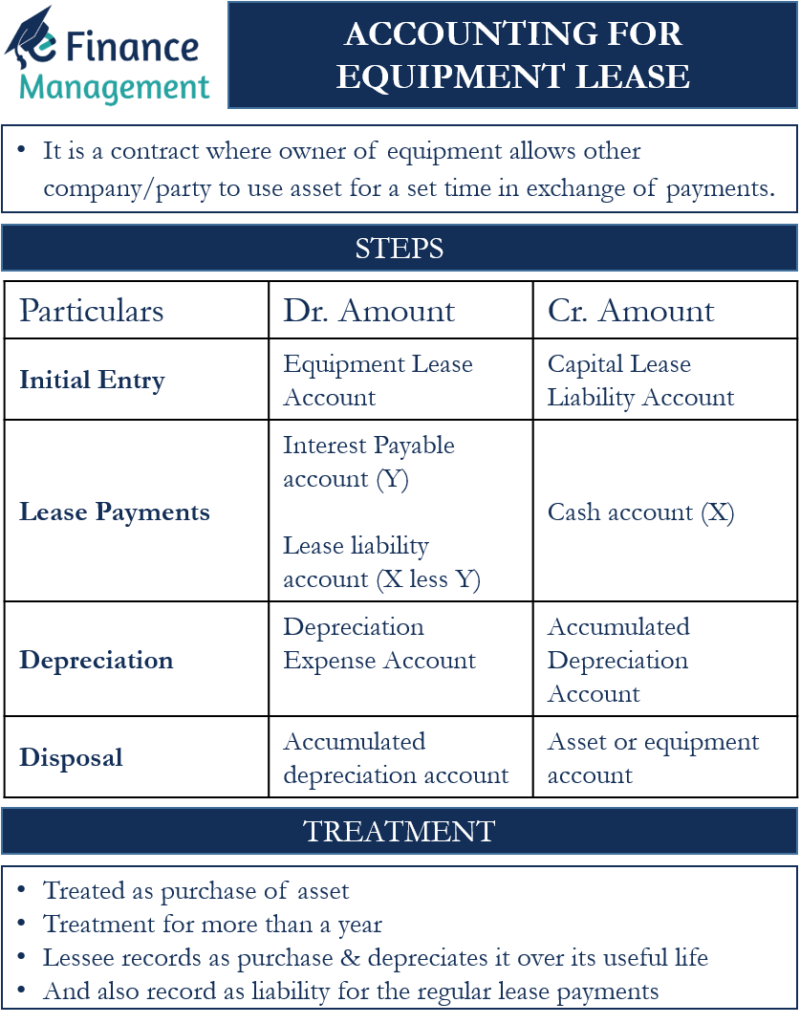

Instead, the lessor (the owner) is responsible for depreciation. Core Scientific, Inc. (“Core Scientific” or the “Company”) is a leader in digital infrastructure for bitcoin mining and high-performance computing. We operate dedicated, purpose-built facilities for digital asset mining and are a premier provider of digital infrastructure to our third-party customers. We derive the majority of our revenue from earning bitcoin for our own account (“self-mining”). “During the third quarter, we continued to grow our HPC business, both in terms of contracted power and total capacity,” said Adam Sullivan, Core Scientific Chief Executive Officer. “To date, we have contracted approximately 500 megawatts of revenue generating, critical IT load that we expect to generate a total of $8.7 billion over the life of the contracts.

Leasing vs. Purchasing: Depreciation & Tax Implications

For example, your basis is other than cost if you acquired the property in exchange for other property, as payment for services you performed, as a gift, or as an inheritance. The basis of property you buy is its cost plus amounts you paid for items such as sales tax (see Exception below), freight charges, and installation and testing fees. The cost includes the amount you pay in cash, debt obligations, other property, or services. If you can depreciate the cost of a patent or copyright, use the straight line method over the useful life.

Financial Reporting

This includes copies of your lease agreements, payment receipts, and a ledger tracking each payment. Inconsistencies in your documentation and reporting can raise red flags with the IRS, so it’s vital to be meticulous and precise. Real property, generally buildings or structures, if 80% or more of its annual gross rental income is from dwelling units. A measure of an individual’s investment in property for tax purposes.

If any of the information on the elements of an expenditure or use is confidential, you do not need to include it in the account book or similar record if you record it at or near the time of the expenditure or use. You must keep it elsewhere and make it available as support to the IRS director for your area on request. Generally, an adequate record of business purpose must be in the form of a written statement. However, the amount of detail necessary to establish a business purpose depends on the facts and circumstances of each case. A written explanation of the business purpose will not be required if the purpose can be determined from the surrounding facts and circumstances.

Small Business Lines & Loans

Equipment depreciation, primarily used for tax filing, allows business owners to deduct the cost of the expensive, but used equipment over its entire life. If you take a Section 179 deduction or depreciation deduction for a vehicle, you must use actual expenses to calculate your vehicle deduction for the remaining life of the vehicle — instead of the standard mileage deduction. This results in the recordation of the asset as the lessee’s property in its general ledger, as a fixed asset. The lessee can only record the interest portion of a capital lease payment as expense, as opposed to the amount of the entire lease payment in the case of the more common operating lease. If none of these conditions are met, the lease can be classified as an operating lease, otherwise, it is likely to be a capital lease. If your vehicle is used for part-personal, part-business than you’ll be able to choose between the Actual Expense Method and the Standard Rate Method.

The use of the automobile is pay for the performance of services by a related person, so it is not a qualified business use. To determine whether the business-use requirement is met, you must allocate the use of any item of listed property used for more than one purpose during the year among its various uses. The business-use requirement generally does not apply to any listed property leased or held for leasing by anyone regularly engaged in the business of leasing listed property.

However, if MACRS would otherwise apply, you can use it to depreciate the part of the property’s basis that exceeds the carried-over basis. For information about qualified business use of listed property, see What Is the Business-Use Requirement? Understanding these tax implications helps you make informed decisions about leasing equipment. Whether leveraging Section 179 for immediate deductions or navigating conditional sales contracts for depreciation benefits, knowing the rules can save your business money and improve financial planning. Both buying and leasing should include tax deductions and future resale value when assessing equipment costs.

You must first determine whether your agreement is a lease or a conditional sales contract. If the agreement is a lease, you may deduct the payments as rent. If the agreement is a conditional sales can you depreciate leased equipment contract, you consider yourself as the outright purchaser of the equipment. You may generally recover the cost of such property used in a trade or business through depreciation deductions.

The ADS recovery periods for property not listed above can be found in the tables in Appendix B. Rent-to-own property, residential rental property, and nonresidential real property are defined earlier under Which Property Class Applies Under GDS. 587 for a discussion of the tests you must meet to claim expenses, including depreciation, for the business use of your home. You can take a special depreciation allowance to recover part of the cost of qualified property (defined next) placed in service during the tax year. The allowance applies only for the first year you place the property in service. The allowance is an additional deduction you can take after any section 179 deduction and before you figure regular depreciation under MACRS for the year you place the property in service.

Property with a long production period and certain aircraft placed in service after December 31, 2023, and before January 1, 2025, is eligible for a special depreciation allowance of 80% of the depreciable basis of the property. The special depreciation allowance is also 60% for certain specified plants bearing fruits and nuts planted or grafted after December 31, 2023, and before January 1, 2025. See Certain Qualified Property Acquired After September 27, 2017 and Certain Plants Bearing Fruits and Nuts under What Is Qualified Property? Under ASC 842, operating leases must be recorded on the balance sheet.